The Peru Economy

The Peru economy is experiencing strong growth thanks to a wide range of exports. Agricultural exports have grown rapidly over the past two decades. In particular, Peru exports high-value fresh fruits and vegetables to countries in the northern hemisphere. These exports have also helped the country reduce poverty in its rural areas. In fact, poverty rates have dropped from 80 percent in 2004 to 36 percent in 2018.

Investor confidence

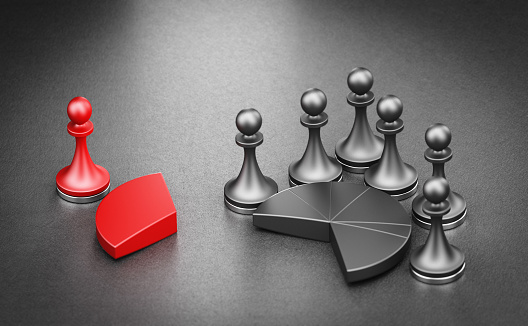

Despite a series of successful measures, investor confidence in Peru’s economy remains low. The government has implemented a variety of policies to boost the economy, including tax exemptions on fuels and some foods, activation of the Fuel Price Stabilization Fund, and increases in the minimum wage. However, the biggest factor limiting the growth of the economy is the weakening of investor confidence. This has resulted in the downgrade of Peru’s long-term foreign currency rating by Moody’s, Fitch, and S&P.

The government recently announced a plan to expand public investment, which will help improve Peru’s infrastructure. This plan also calls for the country to modernize its labor market, bringing more workers into the formal sector. In addition, Peru should also diversify its economy and invest in new technologies. These measures will boost investor confidence in Peru’s economy.

The outlook for Peru’s economy remains uncertain, but overall macroeconomic fundamentals are sound. Peru is expected to grow at less than 3 percent this year, boosted by higher exports. However, domestic demand is forecast to slow, especially amid lower business confidence and unstable energy prices. Furthermore, the country’s poverty rate is projected to remain higher than pre-pandemic levels in the coming years.

Despite these external challenges, Peru’s external position is strong. Its current account balance has been steadily decreasing since 2007, but is still relatively stable. The country’s trade surpluses have gradually narrowed, resulting in accumulated deficits in the current account. In addition, its service balance and factor income have been relatively stable. The country’s transfers’ balance, which accounts for international remittances, has been stable as well. The country is also gaining access to a US$11 billion Flexible Credit Line arrangement with the IMF, which will help support the economy.

Foreign direct investment has also been a positive factor for Peru’s economy. FDI inflows from the United States, the United Kingdom, and Spain are Peru’s leading investors. The mining sector is the largest contributor of FDI, accounting for nearly a quarter of the total. The rest of FDI is split between the finance, energy, and communications sectors.